You don't need a watchlist full of stocks to build wealth. For many Australians, a simple ETF portfolio strategy can do most of the heavy lifting, with fewer decisions and less stress.

An ETF (exchange-traded fund) is a basket of investments you can buy in one trade. Instead of picking winners, you buy a wide slice of the market, then let time and consistency work. Think of it like buying the whole fruit bowl, not trying to guess which single apple will taste best.

This post gives you a clean starter portfolio, how to buy it in Australia, and how to keep it on track without turning investing into a second job.

Pick a simple ETF portfolio that matches your goal and risk level

Australian and global markets side-by-side, a visual reminder of why diversification matters, created with AI.

Australian and global markets side-by-side, a visual reminder of why diversification matters, created with AI.

The "best" ETF portfolio depends on two things: how long you'll invest and how you react when markets drop. If you'll need the money soon, or if a 20 percent fall would make you panic-sell, you'll want more stability. If your time frame is long and you can stay calm through bad years, you can usually take more risk.

This is general information, not personal financial advice. Your tax and goals matter, so use this as a starting point, not a rule.

The 2-ETF core for many Australians, Aussie shares plus global shares

A simple core that fits many long-term investors is just two broad equity ETFs:

- Australian shares ETF: Gives you exposure to local companies, local dividends, and (often) franking credits. It also matches real life spending, since your bills are in AUD.

- Global shares ETF: Spreads your money across hundreds or thousands of companies overseas, often with a big chunk in the US plus other developed markets.

Why not just buy Australia? Because Australia is a small slice of the world share market, and it's also concentrated. Our market leans hard toward financials and miners. If those sectors have a rough decade, a home-only portfolio can lag.

When you compare ETF options, you'll commonly see index names like ASX 200 or ASX 300 for Australian shares, and MSCI World for global developed markets. You don't need to memorize the labels, just recognize the idea: broad index, lots of holdings, no fancy bets.

A simple starting point for a growth-focused investor might be:

- 30 to 40 percent Australian shares

- 60 to 70 percent global shares

That mix keeps a home base in Australia but avoids putting all your eggs in one country.

Add bonds (or cash) if you want a smoother ride

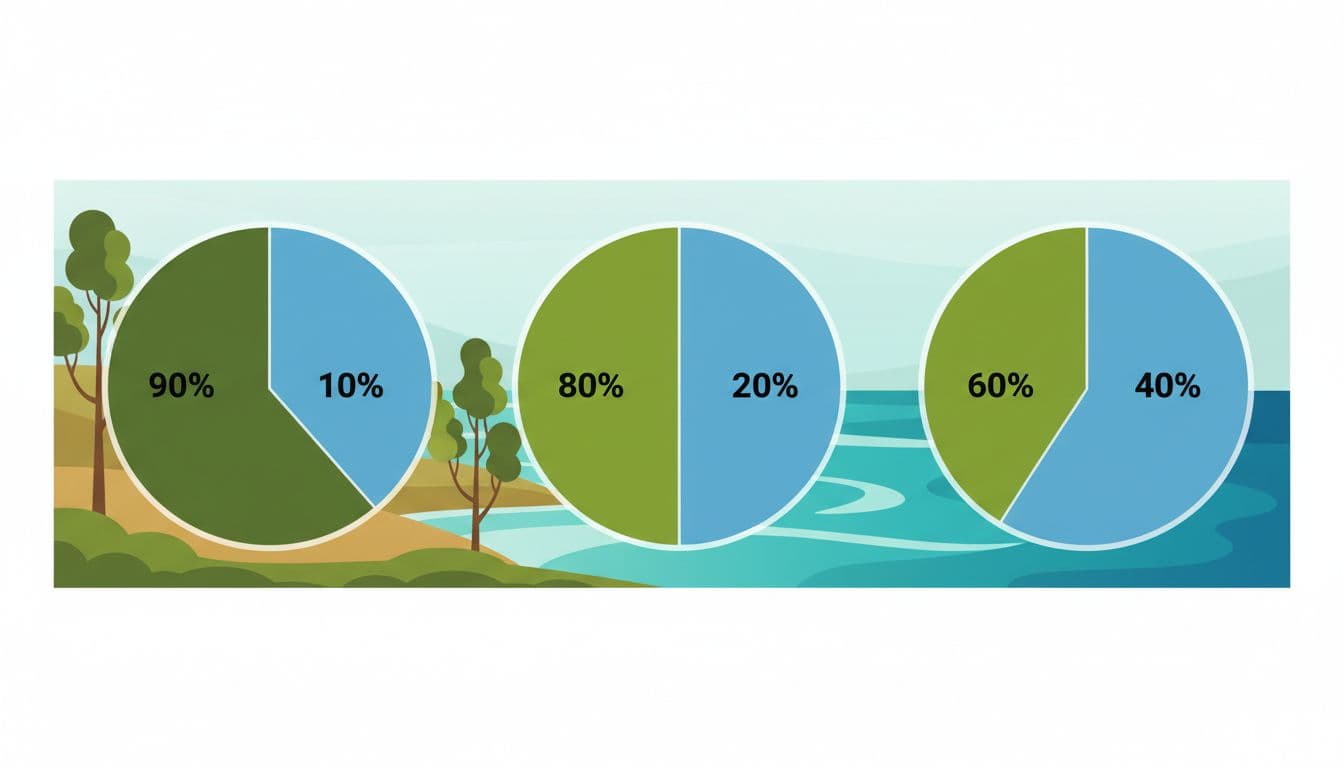

Common stock-and-bond mixes shown as simple pie charts, created with AI.

Common stock-and-bond mixes shown as simple pie charts, created with AI.

Shares can be a bumpy road. Bonds (and sometimes a cash allocation) can make the ride less stomach-churning. Bonds are loans to governments or companies; they tend to move less than shares and can help in stock market downturns.

Bonds may be helpful when:

- Your goal is closer (say, under 5 to 7 years).

- You're a new investor and want fewer big swings.

- You know you'll lose sleep if the market drops hard.

Simple example allocations many people understand quickly:

| Style | Shares | Bonds/Cash |

|---|---|---|

| Aggressive | 90% | 10% |

| Balanced | 80% | 20% |

| Conservative-ish | 60% | 40% |

"Defensive" doesn't mean "no risk." Bonds can still fall, especially when interest rates rise. The point is usually smaller swings and a better chance you'll stick with the plan.

🚀 Start Building Your ETF Portfolio with moomoo

Trade Australian and global ETFs commission-free with advanced portfolio tools and real-time market data!

Open Free Account →*Affiliate link - We may earn a commission at no cost to you

How to build it in Australia, brokerage choice, costs, and smart defaults

Building an ETF portfolio in Australia is mostly admin: open an account, pick the funds, buy, repeat. The biggest win is setting "smart defaults" so you don't rely on motivation.

Start with these practical steps:

1) Choose a broker you'll actually use. Look for clear pricing, easy deposits, and a platform that makes recurring buys simple. If you want a low-cost option many Australians use for ASX ETFs, Stake – Australian brokerage with low‑cost ETFs is one place to compare. If promos or short-term brokerage offers matter to you, Moomoo Australia – commission‑free ETF trading is another option worth checking for current terms and fees.

2) Know your "all-in" costs. With ETFs, you'll usually pay:

- A brokerage fee (or a promo rate) when you buy or sell.

- The ETF's management fee (charged inside the fund, shown as a percentage).

- A small buy-sell spread (the gap between buy and sell price), which is often tighter on larger, busier ETFs.

3) Automate deposits first. Even if you place trades manually, automating the cash transfer removes friction. Consistency beats perfect timing.

What to look for in ETFs, fees, diversification, and structure

A few quick checks keep you out of trouble:

Management fee: Lower fees matter because they compound against you every year. A small difference can add up over decades.

Index tracked: Broad market indexes are usually simpler and more diversified than narrow themes.

Number of holdings: More holdings often means less single-company risk (not a promise, just a general guide).

Australia-domiciled vs US-domiciled: Australia-domiciled ETFs are often simpler for tax paperwork for Australians. US-domiciled funds can add extra forms and tax quirks. Many beginners stick with Australia-domiciled for less hassle.

Liquidity and spread: If an ETF trades actively, it often has a tighter spread. That usually means less cost when you buy and sell.

A beginner-friendly buying plan, lump sum vs dollar-cost averaging

If you already have cash ready, a lump sum gets your money working sooner. If you're building savings from each paycheck, dollar-cost averaging (regular buys) keeps it simple.

A practical approach:

- Keep an emergency fund separate (many people aim for a few months of expenses).

- Pick a buy schedule you can stick with, like monthly or fortnightly.

- Buy your chosen ETFs on that schedule, then ignore the noise.

If markets fall after you buy, that's not "bad timing," it's normal. Regular buys mean you'll also purchase at lower prices over time.

Keep it simple for the long run, rebalancing, taxes, and common mistakes to avoid

An organized setup for annual check-ins and basic rebalancing, created with AI.

An organized setup for annual check-ins and basic rebalancing, created with AI.

The goal is a portfolio that runs in the background of your life. You're not trying to be "active," you're trying to be consistent.

Rebalancing rules that do not require constant checking

Rebalancing is just bringing your mix back to target. If shares surge, your portfolio can drift riskier. If shares fall, you might drift more defensive than you planned.

Two simple methods:

- Calendar method: Rebalance once per year (pick a month you'll remember).

- Drift method: Rebalance only if your allocation moves about 5 percent away from target.

A simple habit that reduces trading is using new contributions to rebalance first. If global shares ran up, aim your next few buys at Australian shares (or bonds) until you're close again.

Taxes and paperwork basics for Australians, dividends, distributions, and CGT

ETFs in Australia often pay distributions (similar to dividends). You'll see these reported for tax time, even if you reinvest them.

What to expect at a high level:

- Australian share ETFs may pass through franking credits, which can reduce tax for some investors.

- Selling an ETF for a profit can trigger capital gains tax (CGT).

- If you hold an investment for more than 12 months, you may qualify for the CGT discount (for individuals, in many cases).

Keep basic records: buy dates, amounts, and any DRP (distribution reinvestment plan) details. If your situation is complex (multiple incomes, trusts, or lots of selling), get tax advice.

Common mistakes that wreck "simple":

- Changing your plan every time headlines get loud.

- Buying too many overlapping ETFs that all hold the same big companies.

- Investing money you might need soon.

💎 Ready to Start Your ETF Portfolio?

Build a diversified portfolio with moomoo's commission-free ETF trading. Advanced tools, real-time data, and expert research—all in one platform.

Start Trading Free →*Affiliate link - We may earn a commission at no cost to you

Conclusion

A simple ETF portfolio strategy for Australians isn't about being clever, it's about being steady. Pick a risk level you can live with, build a small set of broad ETFs (often Aussie shares plus global shares, with bonds if you want a smoother ride), then buy on a schedule. Rebalance once in a while, keep records for tax time, and let compounding do its work.

Choose your target allocation today, set your first recurring deposit, and make patience the main strategy.

Disclaimer: This article is for educational purposes only and does not constitute financial advice. ETF investing carries risks including potential loss of capital and market volatility. Past performance is not indicative of future results. Consider your financial situation, investment objectives, and risk tolerance before investing. Always conduct your own research and consider seeking advice from a licensed financial advisor. We may earn commissions from affiliate links at no cost to you.